How Does A Baton Rouge Home Appraiser Determine Pool Value?

Question and Answer…

QUESTION: I live in a new subdivision in Ascension Parish and if I added a pool to my back yard, how does an Appraisor determine the homes new value or does it actually add more value?

Hi,

First, I tell homeowners an inground pool in an investment in family fun, but it’s really not an “investment” because of high negative return if they choose to or forced into a sale.

If you’re going to live there forever and you want a pool, then add and enjoy your pool not expecting much of a return on it at time of sale.

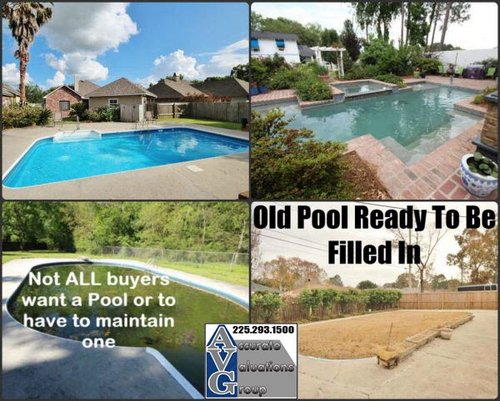

In your newer subdivision, a pool would have more value to a potential buyer over a longer period than say in a 45-50 year old subdivision such as Sherwood Forest or even Shenandoah Estates where the pool might be 30+ years old. I often see older pools more ready to be filled in with dirt than ready for years of more enjoyment.

It also depends on quality, is it a lower cost lower quality vinyl liner pool or higher cost higher quality gunite pool, which may be an over improvement in your subdivision.

For valuation, these are points Appraisers consider:

1.) Price range of home with pool. If home is in a $100,000 lower cost subdivision, then a pool won’t have much extra value as compared to a home with pool in a $250k to $300k subdivision. In CCLA in $650k to $1,500,000 range, buyers may be more willing to pay near cost for a custom gunite pool on a resale.

2.) Age of pool at time of resale, see above. The newer the pool, the more extra value it will have…

3.) Predominance of pools in a subdivision or market – is it common for homeowners to install them and resale buyers to desire pools? I think it’s much more common in Texas and Florida than it is in Baton Rouge.

A recent aerial map helps Appraisers and mortgage underwriters reviewing appraisals study a market to understand predominance. If there’s 800 homes in a subdivision and only 6 have ig pools, then the value added may be lower or non-existent indicating an ig pool in that market may be an over improvement.

4.) Mortgage Underwriters want comps with same or similar features.

If an Appraiser gives any extra value to any extraordinary feature such as a pool, outdoor kitchen or metal workshop, mortgage underwriters want comps used with same features if available, even if that means we use older sold comps (by date of sale) or extending our comp search area out further from subject. Underwriters want to see proof buyers were willing to pay say, $5,000, $7,500 or $10k extra for a pool.

5.) Matched Pairs Analysis. Generally Appraisers study say 10 comps of similar homes as subject to understand what the market is paying and then study say 3 comps with pools to discover if there’s any extra value added and if so, how much. This is called Matched Pairs Analysis. This gets complicated when say a subject is updated, has slab granite and pools and comps used are not updated, lack slab granite but do have a pool.

For example, in Ascension Trace Subdivision in Darrow, there’s a smaller 1150sf +/- that would normally sell in mid $130’s based on several sold comps but is listed at like $149,900 because it has a liner pool. It may have sold by now and say it sold for $143,000. This would indicate to Appraisers buyers were willing to pay $8,000 extra for a $25,000 ig pool.

What if there are no comps to use with similar pools?

Then, the likelihood of Appraisers applying extra value begins to diminish because they don’t want to fight with a mortgage underwriter after report has been submitted. Underwriters will generally stip the appraisal for extra comps or reasoning on why the Appraiser applied value for a pool when the market isn’t showing proof of such.

Guidance of 15%, 25% to 30%….

In training, Appraisers are taught on average, site value is generally 20% to 30% of total home value. Appraisers among themselves fall back on the range of 15% to 30% of cost of an extraordinary feature such as a pool at resale time as a starting point in their mind. Appraisers then study the market solds to discover whatever validity there may be.

Why 15% to 30% of cost? Because over time and study, we’ve seen buyers willing to pay this range for extras in the backyard. Again, each new appraisal assignment is a fresh start with study required.

Caution: At the beginning I said if you plan to live there forever, add what you want and enjoy your home. I wish I had $100 over the past 24 years for every time I was appraising a situation where sellers thought they would live there forever, over improved their homes, especially in the backyard, and then were forced into a sale via death of spouse, job relocation, death of a child or teenager, divorce, cancer, too old to maintain that much home, too old to climb stairs any longer, etc… And, when they sold, they lost tens of thousands because they over improved far above what the market would pay for such extras.

Hope this some helps. Sorry so long but there’s a lot to this.